Yesterday's post ended up being much longer than I'd intended and I didn't even get to commenting on the original CBC News article about the new "stagflation." This morning I found a relevant article from Jacobin: "Interest Rate Hikes Are Class War Against Workers," that I want to incorporate, and, also, the transcript of Bank of Canada Governor (2001-2008) David Dodge's remarks to Canadian Society of New York: "Canada's Experience With Inflation Targets and a Flexible Exchange Rate: Lessons Learned" that is actually a fine example of the nit-wittedness of conventional economic "wisdom" that I hope to discuss.

So, without any further ado, the CBC article:

Like a boogeyman to scare children, stagflation is rolled out every now and again by economic prognosticators to warn of how awful things can get if we're bad. Perhaps that's why many economists don't seem to be taking the threat seriously.

What is meant by the words "if we're bad"??? Does this mean that something Canadians do collectively will cause stagflation to punish us for it? Like, maybe, "excessive wage increases" or "fiscal irresponsibility" such as providing improved public services and welfare benefits to the unemployed?

Similar to the response after warnings of inflation in 2020, most financial commentators have been saying that the threat of stagflation — an unusual combination of a stagnant economy and steady inflation — is small.

But U.S. Federal Reserve Chair Jerome Powell did not seem as confident this week as he has been in the past.

"I think we have a good chance to restore price stability without a recession, without, you know, a severe downturn," Powell told a news conference on Wednesday.

"No one thinks it's easy, no one thinks it's straightforward, but there is certainly a plausible path … to do that."

So far this is pretty vague. What, specifically is causing inflation? Will whatever Powell is about to propose address those causes?

Powell made it clear that getting inflation under control was the priority, praising his predecessor Paul Volcker, who finally slew the inflation dragon, with interest rates of nearly 20 per cent that drove the 1980s economy deep into recession.

While we're currently far below those levels, Powell pushed rates up half a percentage point, saying he expected the next two moves would also be half-point increases.

This is worrying. That they're looking back fondly at Paul Volcker. Despite what Yanis Varoufakis (whose political-economic thinking I tend to respect) portrays Paul Volcker as some sort of heroic sage in his book And The Weak Suffer What They Must?, I have to say that I don't share this opinion.

In his book, Varoufakis tells the story of the implosion of the Bretton Woods order that culminated in the 1971 Nixon Shock. That was when the United States could no longer play the role of lender and market to the capitalist world. The USA had massive trade surpluses after WWII since most of the rest of the capitalist industrial nations (Europe and Japan) were devastated. The FDR "New Dealers" who were in power in 1945 constructed a system wherein the USA would recycle its trade surpluses to finance the reconstruction of Europe and Japan. As those countries rebuilt they began to export more and more to the USA thus eroding the USA's trade surpluses. Germany and Japan especially became exporting nations. While its trade surplus was shrinking the United States was spending massively on weapons during the Cold War and in the Vietnam War more specifically.

This was a period of fixed-exchange rates for most countries. (Canada, since the 1950's, was one exception.) This was anchored on the Gold Standard. The $US was pegged at $35 for an ounce of gold. But the world was being flooded with dollars and some countries (most notably France) began to doubt the US economy's ability to guarantee their currency's value. They began to demand gold in increasing amounts until the Nixon Administration announced in 1971 that it was leaving the Gold Standard.

This allowed the dollar to float against other currencies and its value began to depreciate. This made German and Japanese imports more expensive and US exports more competitive. The Bank of Japan bought up billions of $US to maintain its value against the Yen.

Then came the 1973 Oil Shock. The end result of all of this was inflation rates of often over 10% annually for much of the decade. Things began to settle down somewhat later in the decade when the temporary shortages caused by the chaos of the 1979 Iranian Revolution produced inflationary panic-buying.

I want to point out something from the previous link:

Endless lines at gasoline stations are the overwhelming image in the minds of Americans who lived through the oil shocks. There was a genuine shortage of gasoline in the United States for a while, as refineries geared to run Iranian crude oil could not produce as much gasoline from other types. However, government policies that regulated the petroleum industry made the situation much worse.

Price controls on gasoline exacerbated shortages, by not allowing rising prices to curb demand. The controls allowed refiners to raise gasoline prices each month based on the previous month’s crude oil price. In an environment of rising prices, the price controls incentivized refiners to withhold gasoline and sell it later at higher prices, rather than selling it today. Further aggravating the shortages, the federal government had an allocation system that did not allow gasoline distribution to adjust to demand conditions around the country. Some states also established a policy that only allowed drivers to buy $5 of gasoline at a time, meaning that they had to buy more frequently, virtually assuring longer lines.

Keep that in mind as we go forward. Paul Volcker (who Varoufakis says helped Nixon and Kissinger craft their response to the problems of the dollar in 1971) responded to this price rise, as well as the unsustainable imbalances of the post-1971 international economic order with what he described as:

“[A] controlled disintegration in the world economy is a legitimate objective for the 1980s.”

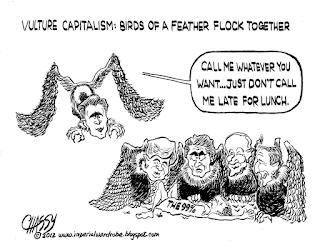

This meant prime interest rates of over 20%. I've written about this many times here at this blog. High interest rates caused a massive recession. (People weren't borrowing to buy houses or cars at 20% interest.) This devastated the construction, automobile and steel sectors. Unemployment soared. (A desired outcome for Volcker and his bosses. A weak, traumatized labour movement is less likely to fight back. Right-wingers Ronald Reagan and Margaret Thatcher saw the disarray of Keynesianism as a justification to impose their bone-headed notions of "free market economics" upon their societies, which included assaults on trade unions and de-regulation of capitalism. High unemployment recessions also meant reduced government revenues which meant bigger government deficits. Big deficits and debts were used to justify public austerity. Especially since the assholes who engineered all of this blamed the deficits on lazy workers who had become "dependent" and "demoralized" by social welfare programs that sapped their work ethic.

So, yeah, ... anyone praising Paul Fucking Volcker doesn't sit well with me. Back to the CBC:

But there are some who fear the current U.S. central banker has waited too long to hike rates, allowing rising prices to get a foothold and making recession inevitable, even as North America faces surging imported inflation.

Those people and their fears should be disregarded. Because the inflationary pressures that we have been seeing have mainly been the result of temporary supply chain problems caused by the Covid pandemic, ... capitalist price gouging and profit-taking using the pandemic as a cover for their greed, and, finally, the trend of oligarchs to take the trillions and trillions of dollars they received during the era of "Quantitative Easing" to push up prices, most notably real-estate and housing. Oh yeah! How could I forget? The coming high inflation rate is going to the the inevitable, foreseen (or should have been foreseen) increases in food prices resulting from Washington provoking Moscow to invade the Ukraine.

A tight monetary policy is one way to "cool off" an over-heating economy. But that's not what is happening here. The world economy was being thought to be bouncing back from the pandemic slowdown but that, and a small, brief uptick in workers' wages, (and the pittance public supports for workers during the pandemic) have had practically zero influence on the price level. Labour's share of the economy has been sinking for decades. Wages have stagnated for decades. To blame workers is to say that this state of affairs was intended to remain permanent. Using monetary policy (interest rates) to bring down the current inflation is, therefore, stupid. And anyone proposing this is an ignoramus. Continuing:

A number of prominent U.S. commentators, including former U.S. treasury secretary Larry Summers and economist Mohamed El-Erian, have been warning that rate hikes, while too late to stop people from expecting persistent inflation, could themselves nudge the U.S., Canada and the world into recession — and into stagflation.

There's that "inflationary expectations" again. Central Bankers were supposed to move in with higher interest rates as soon as prices began to rise in order to signal to everyone else that they were SERIOUS about fighting inflation. So don't nobody get any ideas about wage increases or whatever to compensate for inflation!!! But, as argued, it's not the case that rate hikes would be "too late" to stop inflation, they're the wrong medicine. But, buy increasing the cost of money, while the cost of everything else is going to rise regardless, higher interest rates could make things much worse.

Recently that view has spread beyond the worrywarts, as demonstrated by the normally cautious Conference Board of Canada putting out a report entitled Could Inflation's Surge Lead to Stagflation?, explaining how it could happen in Canada.

The weird thing about stagflation, and why it so seldom occurs despite repeated frightening predictions, is that under normal circumstances, two traditional preconditions — inflation and falling GDP growth — are economic opposites and don't often occur together.

But it's not weird. As I argued in my last post, stagflation happens for reasons. In the past, a poor harvest would mean reduced incomes for farmers and higher food prices for everyone else. Wars that interrupted trade, in places that couldn't build or even afford armaments would depress the economy and increase prices. Increasing the price of money (the interest rate) to lower inflation in such situations would be stupid as they would impose higher costs on anyone who needed to borrow (such as the state to feed its people) without improving things for anyone else. Of course you can't just print money. (Which is what monetarists insist is the only other alternative to tight money policies.) But price controls are a much better solution.

"When I was a graduate student, all the professors would say, 'Oh, we'll never see this era again of letting the inflation genie out of the bottle,'" economist Constance Smith, a professor emeritus at the University of Alberta, said wryly.

Like others who lived through that time, she remembers it as being "unpleasant" — a term echoed exactly by Powell from his own memories, as repeated attempts by central banks to quash inflation failed to convince people that prices would stop rising.

Let me tell you: I'm an old fogey and I lived through the 1970's and 1980's too. The 1970's were MUCH better than the 1980's. Inflation in the 1970's was easier to deal with for unionized workers who could bargain for Cost of Living Allowances. (Furthermore, who thinks that inflation didn't make mortgages easier to pay?) The 1980's saw the HORRIBLE Volcker recession, society-wreaking austerity and assaults on workers (both through direct attacks on unions AND de-industrialization as jobs were lost to the "Third World" and Japanese imports.

Smith remembers constant battles over wage demands eventually leading to cost-of-living adjustments, or "COLA clauses," being written into employee contracts, to assure that workers' incomes would not constantly shrink due to unpredictable inflation.

Oh! How awful! "Battles over wage demands"!!! How did we, as a society, ever survive? Much better to impose a massive recession with crushing interest rates and then subsequently slash the public sector to pay for the massive deficits created. (Deficits are bad you see. But you can avoid punishing the perpetrators if you blame them on someone else! Like, f'rinstance, the people you threw out of work!)

Like others who warn of the dangers of stagflation's return, researchers at the Conference Board of Canada suggest it is not merely current inflation, but the expectations for continued inflation, that will make the difference.

Gahh!!! I suppose I'm going to have to read that Conference Board of Canada study too! (I'm certainly going to have to wait for another post to discuss the Jacobin and David Dodge links.) Anyhow, ... what is the CBoC trying to say? Prices ARE going up. Either because of the supply chain, or the war in the Ukraine, or the brazen arrogance and greed of the oligarchy. So just whose expectations are to be targeted? Since this CBC article itself has so far said nothing about corporate profit, are we to assume that it is workers' expectations that are going to be targetted? As in, workers better not plan on getting any silly ideas about wage increases. Central Bankers are prepared to cause a recession rather than allow workers to contribute to a wage-price spiral!

The Conference Board report draws parallels with the 1970s, and while it says there are differences, "there are similarities between the two eras, which implies that stagflation remains a risk to the outlook that can't be dismissed out of hand."

Yeah. I'm definitely going to have to read that report. Because I don't see many parallels. I don't see anything that makes a tight monetary policy a relevant response to our current situation.

Continuing:

Using economic modelling, the researchers conducted a simulation of the Canadian economy through 2024, where inflationary expectations become embedded well above two per cent.

"The model results remind us of how devastating inflation can be to the real side of the economy as buying power is quickly eroded," reads the report. "The resulting situation is not unlike the stagflation that occurred in the 1970s, when higher consumer prices fed into wages as workers demanded higher wages to match price increases."

The report warns that as well as stimulative interest rates and high government spending, another similarity to the 1970s is the impact of imported inflation.

Instead of an OPEC-driven oil price hike, we now have the Russian invasion of Ukraine driving up the price of energy and food, continued supply-chain distortions from the pandemic's earlier waves and, most recently, the shutdown of Chinese cities, as Beijing tries to corral an outbreak of the Omicron variant.

But what isn't similar to the 1970's is that in the 1970's you had a much more unionized labour force that had become used to high employment and economic stability. You had a capitalist class that didn't have the gargantuan power and wealth levels that we have today. The massive inequality and wage stagnation of the past forty years is a significant difference. A HUGE part of the inflationary pressure today is corporate profit-taking.

How will raising interest rates do ANYTHING to remedy these problems?

Those forces are likely to continue to push prices — and inflationary expectations — higher, even as American and Canadian central bankers hike rates to try to smother domestic demand.

Why "smother demand"??? It isn't the case that people have tons of money in their pockets that they're spending like drunken sailors. The people who have the money are the oligarchs and they're the ones raising the prices of everything, especially housing. About the only benefit for raising interests rates would be to destroy the stock market as oligarchs attempt to move from stocks to bonds. But the inflation in the stock market could have been avoided by having not pumped trillions and trillions of QE money into the hands of the oligarchy.

On Friday, when Canada's latest jobs numbers come out, economists predict employment will continue to surge, exacerbating the worker shortage and helping to drive up wages.

These idiots are obviously ignorant to the increasing costs of housing and the coming increases in food and fuel prices caused by Biden's insane war on Russia. There have been some wage increases of late but they were long overdue and they're being eroded (as always) by capitalist greed. From that Washington Post link:

In the U.S., wage growth is being wiped out entirely by inflation Rising prices have erased U.S. workers’ meager wage gains, the latest sign strong economic growth has not translated into greater prosperity for the middle and working classes.

Shit! I just saw that WaPo was from 2018! Oh well. It still suits my purposes to use it. Let's try again. Here's CNBC: "Inflation has taken away all the wage gains for workers and then some."

What looked like a big jump in workers’ wages during October turned into just another gut punch after accounting for inflation.

The Labor Department reported Friday that average hourly earnings increased 0.4% in October, about in line with estimates. That was the good news.

However, the department reported Wednesday that top-line inflation for the month increased 0.9%, far more than what had been expected. That was the bad news – very bad news, in fact.

That’s because it meant that all told, real average hourly earnings when accounting for inflation, actually decreased 0.5% for the month. So an apparent solid paycheck increase actually turned into a decrease, and another setback for workers still struggling to shake off the effects of the Covid pandemic.

“For now, inflation is going to continue to run above very solid wage growth,” said Joseph LaVorgna, chief economist for the Americas at Natixis and former chief economist for the National Economic Council during the Trump administration. “This is why when you look at consumer confidence, it’s really taking a beating. Households do not like the inflation story, and rightly so.”

And, as you can see from that Washington Post link, this is obviously the continuation of a trend.

Back to the CBC article:

As Powell noted, strong employment and healthy savings mean the economy can survive the required destruction in demand. Another way to say it, is that it has a long way to fall.

With so many forces pushing prices higher, even as he channels Paul Volcker, the world's most powerful central banker made it clear he knows that bringing the North American economy to a soft landing — one without a sharp downturn and free from stagflation — will be difficult.

"It's been a series of inflationary shocks that are really different from anything people have seen in 40 years," said Powell. "And it's obviously going to be very challenging."

Jerome Powell is obviously a complete fucking idiot. It's his goddamned job to know that the majority of US-American workers are suffering from precarious employment with stagnant wages that are now being increasingly eroded by inflation. Half the working population have no savings to speak of. The recovery from the pandemic has been tentative. Corporate profit-taking has been the main source of inflation, either recently using the pandemic as an excuse or long-term, as they took their publicly subsidized bail-outs and QE (which propped-up their imaginary stock prices) and used their billions to push up the price of housing. Workers have nothing to do with causing the fuel and food shocks from Biden's needless provocation of Russia.

For all of these reasons, the long-standing threat to use tight-money to break workers is the most-wrong response there could possibly be to our current crisis. It's frightening to read such stupidity and ignorance from policy-makers.

No comments:

Post a Comment